When Amazon announced plans to cut around 14,000 corporate positions worldwide, many saw it as a sign of trouble. In reality, it’s not a story about crisis but about a calculated transformation. At YourDailyAnalysis, we view this move not as austerity, but as a structural shift – a strategic redesign of Amazon’s internal architecture around artificial intelligence, which is no longer just a product, but the very core of the company’s operating model.

With over 1.5 million employees globally, Amazon is no longer chasing headcount growth for its own sake. The cuts represent roughly 4% of its corporate workforce, mostly mid-level managers and administrative roles. The reasoning is clear: the company wants fewer layers and more ownership. As Senior Vice President Beth Galetti put it, “we need fewer levels and more owners.”

At first glance, this decision seems counterintuitive. In the second quarter, Amazon’s sales rose 13% year over year, reaching $167.7 billion, beating Wall Street’s expectations. So why cut jobs in a moment of strength? The answer lies in the changing economics of innovation. AI is not just a technological upgrade – it’s reshaping how companies think about productivity and structure. Amazon is betting that agility now matters more than scale.

At YourDailyAnalysis, we see this as a watershed moment. For the first time, a major tech company is laying off workers not due to shrinking demand or a weak economy, but to accelerate its technological metabolism. AI has become not just a product to sell but an internal justification for restructuring. Amazon is turning its corporate machine into a self-adjusting system, where algorithms replace administrative chains and decision-making bottlenecks.

Behind the layoffs lies an enormous investment cycle. Amazon is pouring tens of billions of dollars into data centers and cloud infrastructure – a move we consider a strategic necessity to compete with Microsoft and Google. Cutting office-based roles frees up capital for these investments while protecting profitability. In essence, Amazon is trading people for processing power – and doing it ahead of the curve.

One of the most symbolic elements of this restructuring is the trimming of HR. Up to 15% of the People Experience & Technology division may be affected – a striking message from a company once synonymous with massive hiring. As we at YourDailyAnalysis note, this signals the end of Big Tech’s “hyper-hiring” era. Growth is no longer measured in headcount, but in computational capacity.

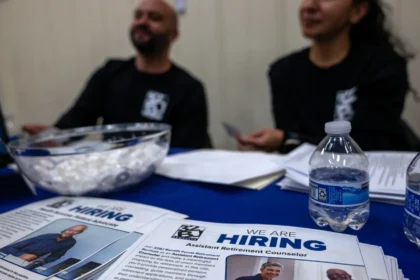

Interestingly, while reducing corporate staff, Amazon is simultaneously hiring 250,000 seasonal workers for logistics and warehouse operations ahead of the holiday rush. This contrast highlights a dual strategy: flexibility in the physical workforce, efficiency in the corporate one. We interpret it as an attempt to balance short-term retail needs with long-term technological ambitions.

For Amazon’s employees, this moment has become a test of adaptability. CEO Andy Jassy has already said that AI will inevitably reshape jobs: “Some types of work will require fewer people, while others will require more.” In other words, the company isn’t just cutting – it’s conducting an internal selection process, favoring those who can integrate into the AI-driven cycle.

On a broader level, this sends a powerful signal to the entire tech industry. At YourDailyAnalysis, we believe layoffs are no longer a synonym for weakness. They’re becoming a symbol of strategic discipline. Amazon’s move demonstrates to investors that it can redirect capital, streamline operations, and invest in future profit engines – even if that means shrinking in the short term. Yet this strategy also comes with risk: a leaner organization can move faster, but if AI investments fail to deliver the expected returns, it could strain innovation capacity and morale.

For the labor market, the message is clear. Middle management, HR, and coordination-heavy roles are the first to be automated out. Companies are moving toward flatter, faster structures, where value is defined by one’s ability to enhance technology – not manage process. Our advice to professionals in the tech sector is simple: adapt your skill set now. Learn to use AI tools as leverage, master end-to-end product thinking, and prove that you are an amplifier of value, not a link in a chain.

For investors, Amazon remains a critical case study. If the company succeeds in proving that massive AI adoption can lift margins and long-term efficiency, others will follow. If not, markets will demand further “rationalization” rounds to preserve profitability.

Ultimately, Amazon is setting the tone for a new corporate era where the key word is not “growth” but “restructuring.” At Your Daily Analysis, we see this as a conscious, strategic choice: it’s better to get lean now than to rebuild under pressure later. And perhaps that’s the most important lesson – in the emerging AI economy, survival doesn’t belong to the biggest players, but to the fastest adapters.