At the end of September, the Dutch government took a step few in Europe expected: it activated a Cold War–era emergency law to intervene in the operations of the Chinese-owned chipmaker Nexperia. As we at YourDailyAnalysis note, this was the moment when technological geopolitics stopped being an abstract debate and became a direct instrument of state policy. What began as a domestic oversight measure quickly escalated into a crisis that sent shockwaves through an already strained global automotive industry.

In a briefing to parliament, the Dutch economy minister cited “serious governance failures” inside Nexperia that posed a potential threat to national interests. The extraordinary measure granted the government the ability to block company decisions that could undermine production or jeopardize Nexperia’s future as a European technology asset. Formally, the state did not take ownership. But as we emphasize, such supervisory authority amounts to political influence over corporate operations under the banner of national security.

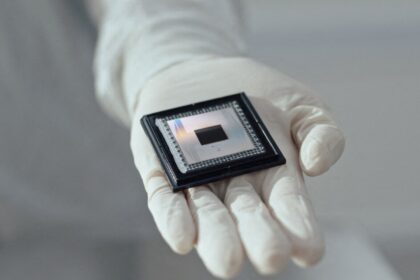

Beijing reacted sharply, condemning the move as political interference. China then halted shipments of Nexperia chips from its domestic facilities and froze exports of key materials needed for European production. The disruption exposed a structural weakness: Nexperia manufactures foundational semiconductor components – not cutting-edge chips, but essential building blocks used in everything from airbags to steering systems. In our assessment at YourDailyAnalysis, this episode once again proves that the least glamorous parts of the semiconductor ecosystem are often the most strategically sensitive.

Around 70 to 80 percent of Nexperia’s output is shipped to China for testing and packaging. This deep dependency left European automakers vulnerable when Beijing flexed its leverage. Analysts argue that the industry failed to learn the lessons of the COVID-era supply shock, and that the Nexperia turmoil underscores how easily geopolitical pressures can paralyze production chains.

Complicating the situation further is Nexperia’s owner, Wingtech Technology, which has been on the radar of US regulators. Its inclusion in American watchlists heightened scrutiny of Nexperia’s leadership, with Dutch court documents revealing concerns about potential transfers of technology and intellectual property to China. At YourDailyAnalysis, we view the Dutch intervention as part of a larger realignment: Europe is increasingly willing to act in ways that mirror Washington’s approach to strategic technology risks.

Automakers find themselves in a precarious position. While alternative suppliers exist – from Infineon to NXP and Texas-based manufacturers – shifting to them requires lengthy qualification processes and expensive system redesigns. Automotive supply chains grow organically, not on demand, and replacing even a “simple” chip can stall production. All this unfolds against the backdrop of a fragile one-year trade truce between the US and China, making the Nexperia dispute even more delicate.

Our conclusion at Your Daily Analysis is that this case is not an outlier but an early indicator of a broader global reshaping of technological sovereignty. Europe is entering a phase where protecting semiconductor capacity will become as essential as energy or defense security. We expect sustained pressure on Chinese-European joint assets, tighter national controls, and rising complexity in cross-border chip supply chains. For policymakers, the priority is to strengthen early-warning mechanisms and support local manufacturing resilience. For companies, the message is equally clear: diversify supply chains now, before the next geopolitical shock turns a critical component into a point of failure.