At YourDailyAnalysis, the emerging memory shortage is best understood not as a routine semiconductor cycle but as a structural reallocation shock driven by the capital intensity of artificial intelligence infrastructure. The current imbalance is less about a sudden collapse in consumer supply and more about how production capacity is being redirected toward higher-margin, AI-oriented memory products.

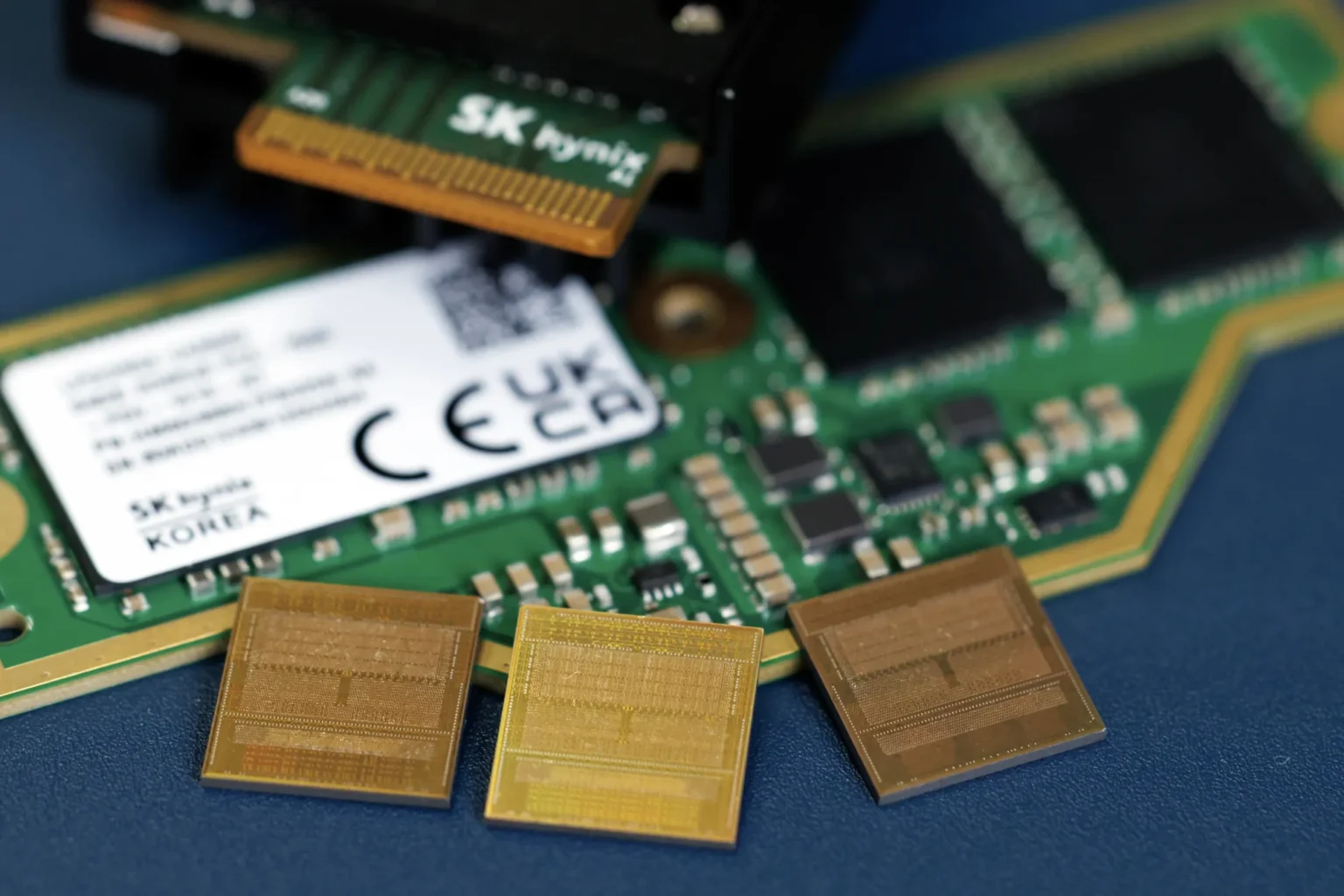

The core dynamic is straightforward. Hyperscalers and AI model developers are aggressively securing advanced accelerators that require large volumes of high-bandwidth memory and server-grade DRAM. As a result, memory manufacturers are rationally prioritizing these premium segments. The unintended consequence is tightening availability of conventional DRAM used in smartphones, laptops, networking equipment and automotive systems. In this framework, scarcity does not stem from excessive consumer demand but from a strategic shift in supply allocation toward AI data centers.

Recent pricing behavior reflects this structural pressure. Accelerating contract resets, rapid spot-price increases, and defensive inventory accumulation suggest expectations of prolonged tightness. When buyers anticipate further price increases, forward ordering intensifies, amplifying volatility. This reflexive cycle reinforces short-term shortages and complicates procurement planning across industries. From a market perspective, YourDailyAnalysis interprets this as a classic supply-side shock with asymmetric sectoral effects.

Memory producers and selected semiconductor equipment suppliers are positioned to benefit from elevated pricing and margin expansion. However, downstream electronics manufacturers face cost compression risk. Price-sensitive segments such as mid-range smartphones, consumer PCs and certain automotive applications are particularly exposed, especially where pricing power is limited. Firms with strong branding, flexible product configurations or long-term supply agreements are better equipped to absorb volatility without sacrificing margins.

Another dimension deserves attention. As shortages persist, procurement becomes strategic rather than transactional. Large technology companies may deepen vertical partnerships, secure long-term capacity commitments, or invest in ecosystem-level resilience. While full-scale vertical integration remains unlikely for most participants, strategic sourcing decisions are increasingly viewed as competitive differentiators. In this respect, YourDailyAnalysis sees memory not merely as a commodity input but as a strategic lever within the broader AI buildout.

Capacity expansion will eventually respond, but structural constraints limit near-term relief. Advanced packaging, wafer allocation and yield optimization require time and capital. This suggests that episodic tightness may persist, particularly around major product launches and data center deployment cycles. Companies that proactively redesign product architectures to allow memory flexibility may mitigate exposure, while those dependent on fixed configurations face greater operational risk.

The broader implication is that AI-driven capital expenditure is reshaping industrial allocation patterns. Memory scarcity illustrates how concentrated infrastructure investment can ripple outward into consumer markets and corporate margins. If sustained, this dynamic may influence earnings revisions, valuation dispersion and risk premiums across technology sectors.

In conclusion, as Your Daily Analysis underscores, the current memory shortage should be interpreted as a structural adjustment rather than a transient anomaly. Artificial intelligence demand is absorbing disproportionate production capacity, creating pricing power for upstream suppliers and cost pressures downstream. Monitoring allocation trends, contract structures and capital expansion timelines will remain critical for assessing whether this imbalance stabilizes or evolves into a longer-term constraint on technology supply chains.