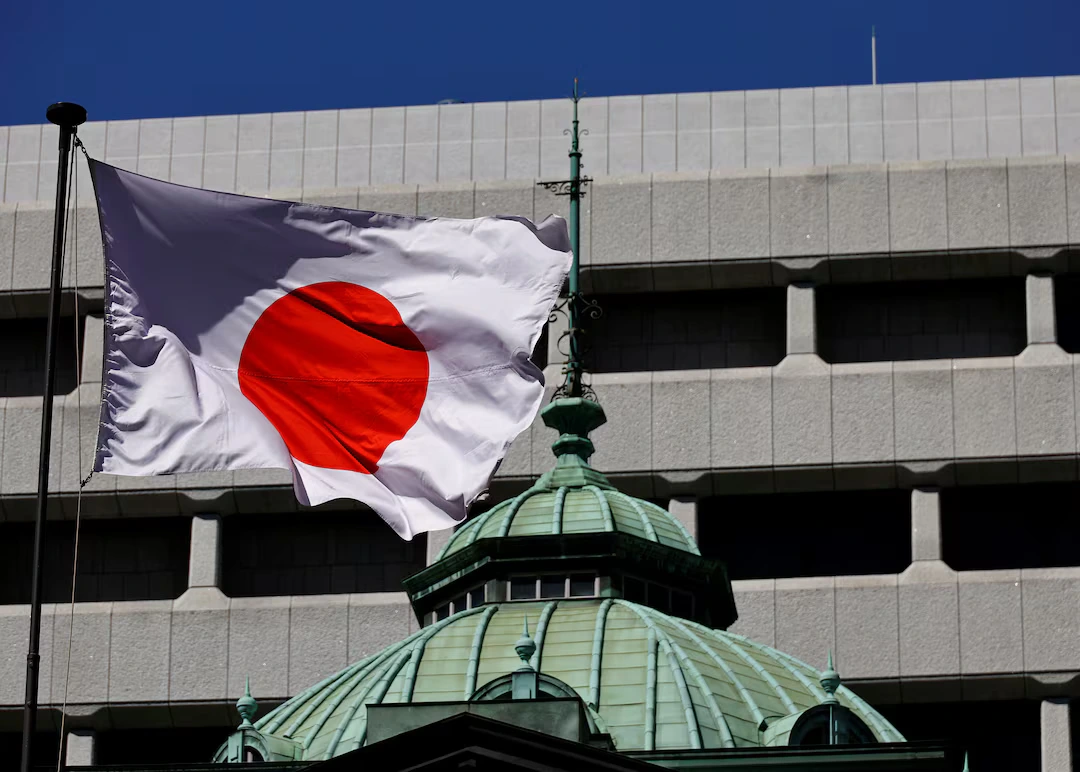

As Japan edges toward its first meaningful phase of monetary tightening in decades, the architect of this shift is a figure long viewed as an academic moderate. Bank of Japan Governor Kazuo Ueda has quietly mastered a form of economic diplomacy – leveraging warnings about persistent inflation and a chronically weak yen – to win Prime Minister Sanae Takaichi’s backing for a December rate hike. Until recently, such a move would have been politically unthinkable. Now, with markets almost fully pricing in an increase to 0.75%, Japan stands on the threshold of a far more complex challenge: defining what comes after the first step away from the ultra-easy era.

At YourDailyAnalysis, we have noted that Ueda has “created a rare line of direct communication inside Japanese policymaking,” transforming currency weakness and inflation anxiety into arguments that the administration could not easily dismiss. His December speech – effectively pre-approved by the cabinet – signaled to markets that political resistance had cracked, at least for now.

Yet the trajectory from here is murky. That path, more than the hike itself, will dictate bond-market behavior, foreign investor sentiment, and the political latitude available to Tokyo. As one of our analysts at YourDailyAnalysis observes, “Japan is confronting something it hasn’t seen in thirty years – a point where normalization is inevitable, but no one can define its ceiling.”

The political alignment between Takaichi’s administration and the BOJ emerged not from shared conviction, but from fear: fear of further yen depreciation, fear of imported inflation, and fear that rising prices could erode voter support. These pressures softened the government’s earlier resistance to tightening. According to officials familiar with the talks, the pivotal moment came during a late-November meeting, after which the prime minister accepted the logic of a gradual, data-driven rate-increase cycle.

But attention now turns to a far more delicate issue: how Ueda will communicate the boundaries of future tightening when no consensus exists on Japan’s neutral rate, which the BOJ estimates somewhere between 1% and 2.5%. This enormous spread leaves investors reluctant to commit to longer-dated JGBs – uncertain where the ceiling truly lies. In our view at YourDailyAnalysis, this uncertainty will be one of the major volatility catalysts in early 2026.

Ueda himself has acknowledged the ambiguity. His caution may be prudent, but it also risks being interpreted as a lack of strategic clarity. While some policymakers argue for holding rates steady after a move to 0.75%, markets are already pricing in roughly 1.5% by mid-2027. That divergence threatens to make BOJ communication a source of instability rather than reassurance.

Years of ultra-easy policy add further complications. Japanese corporates have grown accustomed to near-zero borrowing costs; real-estate markets remain sensitive to rising rates; insurers and pension funds operate within narrow yield tolerances. Any hint of an accelerated tightening cycle could trigger a broad repricing of risk.

Still, the December hike appears close to inevitable. The real challenge is how Ueda frames the forward path – silence would be read as weakness, and excessive clarity as a threat to stability. As YourDailyAnalysis emphasizes, “Japan’s tightening cycle will test not economic theory, but the BOJ’s ability to manage expectations in an environment where political risks rival financial ones.”

By the end of the month, Japan will have a clearer sense of the direction Ueda intends to take. But one thing is already evident: the move to 0.75% will not be a conclusion, but the beginning of a long and fragile process. If Ueda succeeds in balancing certainty with strategic ambiguity, Japan may finally achieve sustainable growth without relying on artificially low rates. If not, volatility could become a defining feature of the next several years.

Your Daily Analysis will continue monitoring the BOJ’s evolving strategy, as December’s decision is poised to become one of the most consequential markers shaping global monetary expectations in 2026.