South Korea’s semiconductor industry is approaching a potentially pivotal moment as SK Hynix Inc. confirmed it is evaluating a possible listing on the New York Stock Exchange – a move that, according to analysts at YourDailyAnalysis, could reshape the valuation landscape for Asian technology companies. The plan is aimed at narrowing the long-standing valuation gap between the memory-chip producer and its global peers, including Micron Technology.

In a regulatory filing, SK Hynix stated that it is reviewing “a range of measures to enhance corporate value,” including the possibility of issuing shares in the U.S. using treasury stock. No final decision has been made, but the announcement itself underscores growing pressure from investors and policymakers to improve corporate governance and transparency. YourDailyAnalysis notes that the initiative aligns with President Lee Jae-myung’s broader campaign to increase corporate valuations – a policy wave that has already helped lift the Kospi index more than 70% this year.

Shares of SK Hynix rose 3.7% in Seoul on Wednesday, reflecting optimism that a U.S. listing could broaden the company’s investor base. A potential ADR issuance could attract capital from passive funds, ETFs, and U.S.-only investment mandates. Experts at YourDailyAnalysis point out that compliance with U.S. disclosure and accounting standards would significantly elevate the company’s governance profile – a factor that tends to reduce the valuation discount applied to South Korean firms.

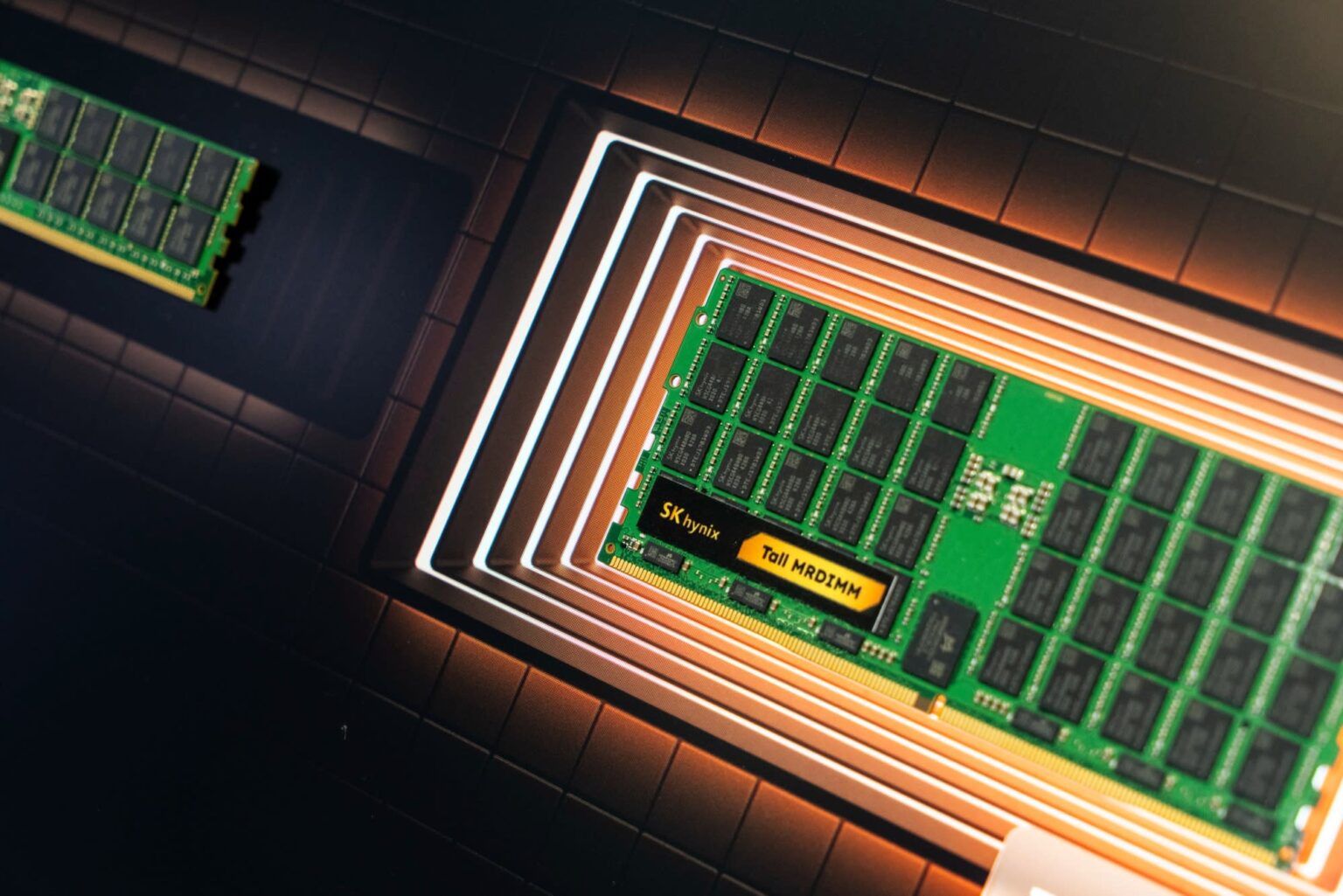

Only a handful of Korean companies, such as POSCO Holdings and KB Financial, maintain listings on the NYSE, underscoring the rarity of such a step. For SK Hynix, however, the strategic rationale is clear. Its stock has surged nearly 240% this year, supported by soaring demand for high-bandwidth memory (HBM), a core component in AI infrastructure. The company has become the leading supplier of HBM chips used alongside AI processors developed by Nvidia and other major semiconductor manufacturers. According to YourDailyAnalysis, SK Hynix’s technological dominance in this segment has widened the gap between its operational performance and its constrained valuation on the domestic market.

Market discussions suggest that SK Hynix has received proposals from investment banks to list approximately 2.4% of its outstanding shares – around 17.4 million shares – in the form of ADRs backed by treasury stock. This structure would avoid dilution for existing shareholders, addressing one of the primary concerns surrounding a potential offering. Industry observers note that the intent is not to raise capital, but rather to elevate the company’s corporate value and diversify its investor base. We at YourDailyAnalysis emphasize that this aligns with ongoing reforms aimed at dismantling the so-called “Korea discount,” historically driven by opaque governance structures.

A key element of these reforms involves discussions around the cancellation of treasury shares – a practice that has long enabled Korean conglomerates to consolidate insider control and influence key decisions. Corporate-governance experts argue that such mechanisms undermine minority-shareholder rights and depress valuations. Strengthening regulatory standards could help restore investor confidence and improve Korea’s global standing as a destination for technology capital.

Despite its rapid ascent, SK Hynix still trades at roughly 7 times forward earnings, significantly below the valuation multiples of its peers: Micron trades above 12x, while Taiwan Semiconductor Manufacturing Co. is valued near 20x. According to analysts at YourDailyAnalysis, this discrepancy reflects structural constraints of the domestic market rather than fundamental underperformance – and a potential U.S. listing may help correct this mispricing by exposing the company to deeper pools of global capital.

As we at Your Daily Analysis conclude, the possible ADR listing is more than a financial maneuver; it signals a broader shift in how leading Asian semiconductor firms position themselves within global markets, seeking governance standards and investor reach that align with their technological scale and strategic ambitions.