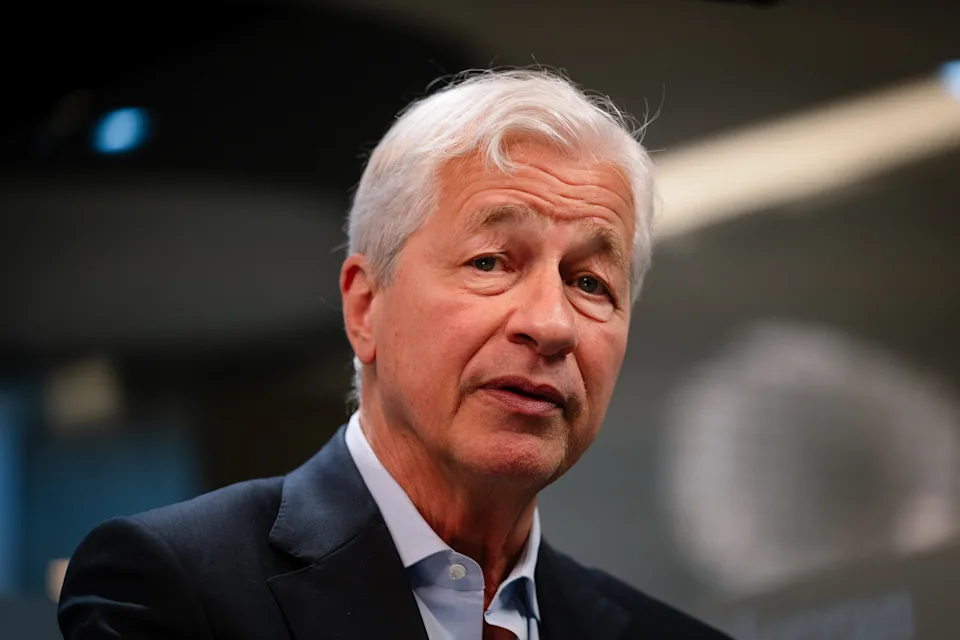

The legal confrontation between JPMorgan Chase and President Donald Trump has evolved into a jurisdictional and strategic dispute that may ultimately shape the trajectory of the case more than the substantive allegations themselves. At its core, the bank argues that CEO Jamie Dimon was improperly named as a defendant in order to keep the lawsuit in Florida state court rather than federal jurisdiction. From the perspective of YourDailyAnalysis, this procedural maneuver is not peripheral – it is central to the legal balance of power.

JPMorgan has moved to remove the case to federal court in Miami and has signaled that it will seek transfer to New York. Venue selection matters because it influences judicial familiarity with federal banking regulation, procedural standards and the interpretative lens applied to executive liability. In its review, YourDailyAnalysis views this as a calculated effort to reframe the dispute from a politically charged narrative into a regulatory and compliance-based defense grounded in federal oversight structures.

The lawsuit seeks at least $5 billion in damages and alleges that the bank closed Trump-linked accounts in early 2021 for political reasons, including claims of a so-called “blacklist” distributed to other financial institutions. JPMorgan has characterized these allegations as vague and unsupported, arguing that they fail to specify what such a list entailed, when it was created, or how it was disseminated. According to YourDailyAnalysis, the evidentiary burden surrounding this allegation is significant: courts typically require clear documentation or demonstrable communication trails to sustain claims of coordinated reputational exclusion.

JPMorgan’s defense also emphasizes the regulatory environment in which large financial institutions operate. Banks are subject to stringent federal supervision, anti-money-laundering obligations, reputational risk controls and compliance frameworks that routinely shape account management decisions. In this context, the bank contends that executive-level liability under a state consumer protection statute is legally misplaced. From an analytical standpoint, YourDailyAnalysis interprets this argument as an attempt to align the case with federal preemption logic – asserting that state-level claims should not override federally governed risk-management discretion.

The broader policy environment provides additional context. Debates surrounding “debanking” have intensified in recent years, particularly where account closures intersect with high-profile political figures. However, financial institutions frequently exit client relationships for operational, compliance or reputational reasons unrelated to political ideology. As noted by Your Daily Analysis, distinguishing between discretionary risk mitigation and unlawful viewpoint discrimination will likely determine the durability of the claims.

Strategically, the immediate inflection point lies in jurisdiction. If the case is successfully moved to federal court and potentially transferred to New York, the bank may gain procedural advantage in narrowing claims or seeking dismissal. Conversely, if the case remains in a plaintiff-favorable venue and proceeds into broad discovery, internal communications and governance processes could face extended scrutiny.

From a forward-looking perspective, this litigation may not produce a sweeping precedent redefining platform or banking liability. Instead, as YourDailyAnalysis concludes, the more probable outcome is a narrower judicial clarification of pleading standards, executive inclusion thresholds and the boundary between state consumer law and federally supervised banking discretion.

For investors and policy observers, the key variables to monitor include venue rulings, early motion outcomes and the specificity of evidentiary claims. While headline damage figures dominate public attention, the practical impact will hinge on procedural decisions that determine how far the case advances. In that sense, the legal chessboard – not the political rhetoric – will define the next phase of this dispute.