Blue Owl Capital’s sharp share price decline has reignited debate around liquidity mechanics in the $1.8 trillion private credit market. The company’s decision to restrict quarterly redemptions in one of its non-traded business development companies (OBDC II) has intensified scrutiny of how retail-accessible private credit vehicles manage structural liquidity mismatches. In the view of YourDailyAnalysis, this development is less about immediate credit deterioration and more about the architecture of liquidity promises embedded in semi-liquid funds.

Formally, Blue Owl did not suspend redemptions outright. Instead, it adjusted the capital return mechanism: investors will now receive distributions funded through loan repayments, asset sales, or other portfolio actions rather than standard quarterly share buybacks. From a portfolio management standpoint, this reflects the inherent tension between long-duration private loans and periodic liquidity windows. As assessed by YourDailyAnalysis, when redemption requests exceed preset thresholds – often around 5% of net asset value per quarter – the underlying asset-liability duration gap becomes visible.

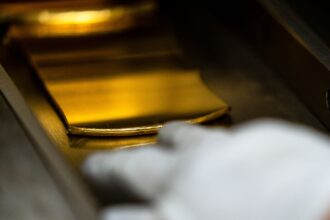

Management emphasized that loans were sold at approximately 99.7% of par value, a data point intended to reinforce confidence in portfolio valuations. Selling near par suggests that pricing assumptions remain broadly defensible and that credit quality has not materially deteriorated. However, according to YourDailyAnalysis, the need to demonstrate valuation credibility through secondary sales indicates heightened investor skepticism regarding marks in private markets more broadly.

The broader context is equally significant. Private credit expanded rapidly during the low-rate environment, filling gaps left by traditional banks and offering attractive yield premiums. With higher interest rates and slower growth now shaping the macro backdrop, concerns have shifted toward borrower leverage, covenant flexibility and refinancing risk. The Blue Owl episode has therefore been interpreted by markets as a potential early stress indicator rather than an isolated fund-level adjustment.

Redemption pressure appears to have intensified following discussions around a proposed merger involving OBDC II that could have implied valuation losses for certain investors. Elevated redemption requests – exceeding standard quarterly caps and reportedly reaching double-digit percentages in certain segments – highlight how investor confidence can erode when structural changes are introduced. In its analysis, YourDailyAnalysis notes that semi-liquid fund models function smoothly during stable inflow periods but can experience strain when liquidity demand accelerates.

Importantly, there is no evidence at this stage of widespread credit defaults within the portfolio. The core issue remains liquidity timing rather than asset impairment. Nevertheless, share price declines among competing alternative asset managers signal that equity markets are pricing in broader sector risk, including concerns about valuation transparency and leverage exposure across private lending platforms.

Structured products linked to Blue Owl experienced additional pressure, reflecting how liquidity narratives can spill over into adjacent instruments. From a systemic perspective, the episode underscores the delicate balance between yield generation and redemption flexibility in private credit vehicles distributed to non-institutional investors.

Looking forward, Your Daily Analysis identifies three variables as critical: the pace of future redemptions, the pricing and scale of additional secondary loan sales, and broader macroeconomic trends affecting leveraged borrowers. If asset sales continue to occur near par and redemption pressure stabilizes, confidence could gradually return. Conversely, persistent outflows may require further portfolio adjustments.

In conclusion, Blue Owl’s decision does not signal a systemic collapse in private credit but rather highlights structural liquidity sensitivities within semi-liquid frameworks. As emphasized by YourDailyAnalysis, investors should differentiate between credit risk and liquidity risk – two related but distinct dimensions. The market is entering a more discriminating phase in which transparency, balance sheet flexibility and realistic liquidity terms will increasingly determine resilience across the alternative asset management landscape.