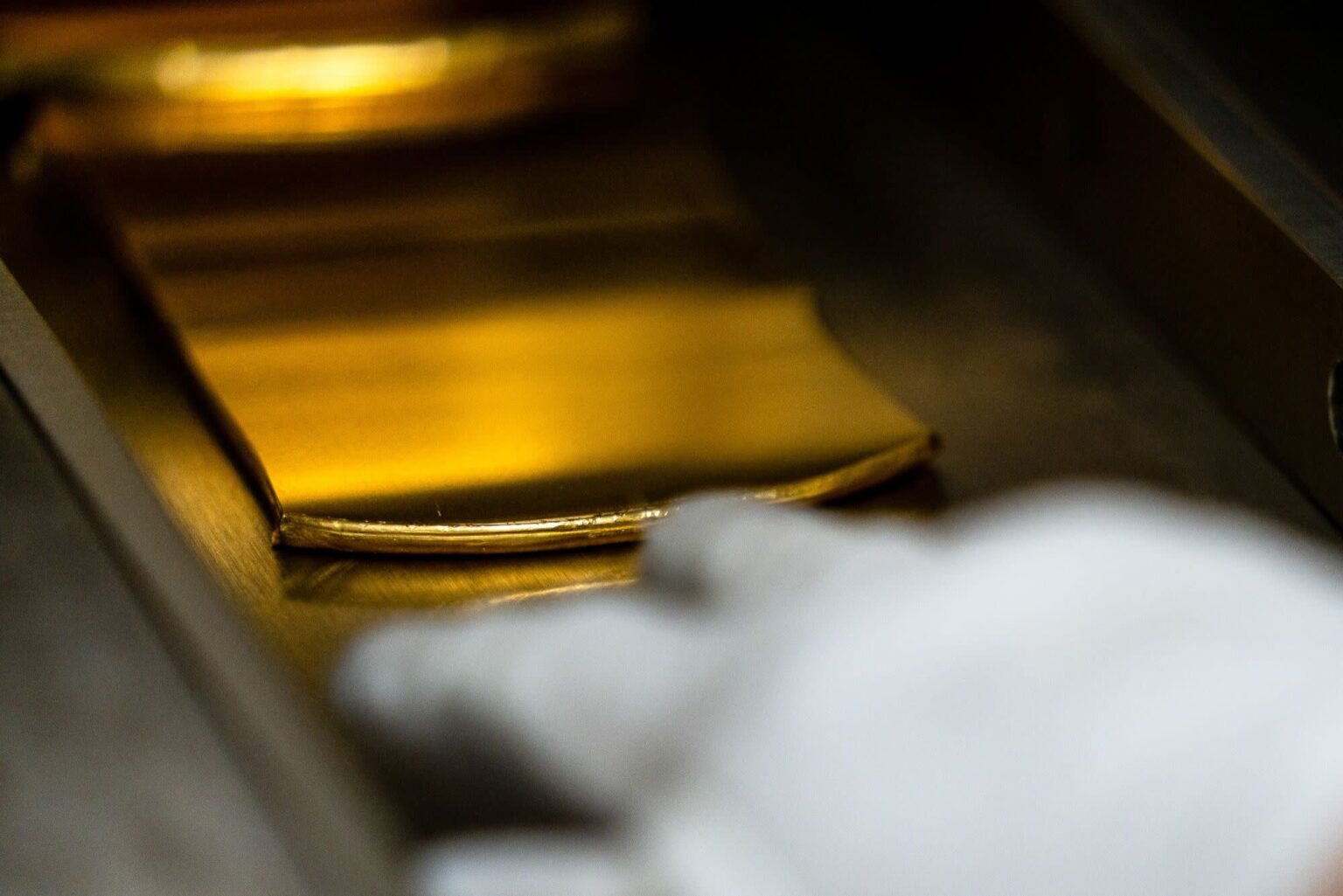

Gold is once again trading at the intersection of geopolitical uncertainty and shifting monetary expectations, hovering near the psychologically significant $5,000 per ounce level. The metal’s price action reflects a dual narrative: renewed global risk tension and recalibrated expectations for U.S. interest rates. YourDailyAnalysis views the current environment as structurally supportive for gold, though tactically volatile.

Geopolitical developments surrounding Iran have reintroduced a measurable risk premium into markets. Statements from U.S. leadership emphasizing a limited diplomatic window and heightened regional military positioning have revived demand for traditional safe-haven assets. Historically, gold reacts not only to active conflict but to elevated probability scenarios involving energy corridors and nuclear diplomacy. According to YourDailyAnalysis, even absent direct escalation, sustained geopolitical ambiguity tends to anchor downside risk for gold prices by reinforcing defensive asset allocation.

However, the market’s response was not linear. Prices initially rose before partially retracing gains, signaling that traders are weighing diplomatic outcomes alongside risk escalation. This pattern suggests positioning adjustments rather than full conviction flows.

Monetary policy remains the second dominant variable. Recent remarks from Federal Reserve officials indicating a stronger-than-expected labor market and stickier goods inflation have tempered expectations for aggressive rate cuts. Higher real yields increase the opportunity cost of holding non-yielding assets such as gold. From a macro perspective, YourDailyAnalysis interprets this as the primary near-term headwind for bullion.

Yet the policy outlook is far from settled. While certain policymakers have adopted a more cautious tone regarding rate reductions, markets continue to price in eventual easing later in the year. Furthermore, public commentary from political leadership advocating lower borrowing costs introduces an additional layer of institutional tension. As highlighted by YourDailyAnalysis, even perceived pressure on central bank independence can enhance gold’s appeal as a monetary hedge.

Beyond short-term policy signals, structural demand factors remain intact. Central banks in emerging markets have continued accumulating gold reserves at historically elevated levels, reflecting diversification away from dollar-denominated assets. This sustained official-sector buying has provided a durable floor beneath prices in recent years.

Volatility across precious metals markets has been pronounced, particularly following the sharp late-January correction. Silver, more sensitive to industrial demand dynamics, remains tied to global manufacturing expectations. Platinum and palladium continue to reflect trends within automotive supply chains and broader cyclical activity.

From a strategic standpoint, Your Daily Analysis considers the $5,000 threshold both psychological and technical. A sustained breakout would likely require either intensified geopolitical disruption or clearer confirmation of monetary easing. Conversely, stabilization in diplomatic negotiations combined with prolonged policy restraint could push gold into a consolidation phase rather than a directional surge.

For investors, the relevant distinction is between tactical fluctuations and strategic positioning. In the view of YourDailyAnalysis, gold functions less as a short-term trading instrument and more as a portfolio stabilizer amid macro uncertainty. Incremental accumulation during pullbacks may offer a disciplined approach in an environment defined by geopolitical unpredictability and evolving rate expectations.

In conclusion, gold’s current price dynamics represent a balancing act between risk sentiment and real yield trajectories. The next decisive move will likely hinge on which factor gains dominance – escalation risk or policy normalization. Until clarity emerges, volatility may persist, but the broader structural case for gold remains intact.