The U.S. housing market continues to operate in a state of structural tension. On the surface, affordability metrics are improving. Beneath that surface, transaction volumes are deteriorating. This divergence defines the current cycle. In YourDailyAnalysis, we examine not just the headline decline in existing home sales, but the deeper imbalance shaping housing dynamics in 2026.

Existing home sales fell 8.4% in January to a seasonally adjusted annual rate of 3.91 million units – the weakest level in more than two years and well below market expectations. Year-over-year sales declined 4.4%. Importantly, these figures largely reflect contracts signed in November and December, meaning weather disruptions were not the primary cause. The weakness appears structural rather than temporary.

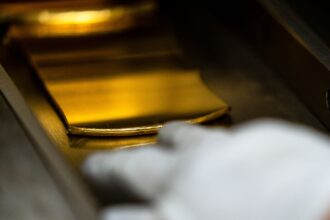

Supply remains the central constraint. Inventory declined to 1.22 million units, representing just 3.7 months of supply. A balanced market typically requires 5–6 months. This shortage is reinforced by the so-called “mortgage lock-in effect”: homeowners with 2–3% mortgage rates remain reluctant to sell and refinance at 6–7%. The result is suppressed turnover rather than collapsing demand. Prices reflect that scarcity. The median existing home price rose to $396,800 – the highest January level on record. While price growth has moderated, there is no meaningful correction. When adjusted for rising insurance costs, property taxes, and maintenance expenses, the effective burden on buyers remains elevated.

Affordability improved on paper, with the housing affordability index rising to 116.5, its strongest level since early 2022. Wage growth has outpaced home price growth, and mortgage rates are lower than a year ago. However, as we highlight in YourDailyAnalysis, improving affordability driven by falling transaction volumes is not the same as a structurally healthier market. Activity is cooling faster than prices.

Mortgage rates remain closely tied to 10-year Treasury yields. While policy interventions in mortgage-backed securities markets have provided episodic relief, persistent inflation concerns and elevated federal debt levels limit the probability of a sustained rate collapse. Without a durable decline in yields, housing demand is unlikely to accelerate meaningfully.

First-time buyers accounted for 31% of sales – an improvement from a year earlier but still well below the 40% threshold associated with a stable housing ecosystem. As YourDailyAnalysis highlights, structural barriers remain significant: high down payments, student loan burdens, and insurance costs continue to weigh on younger households.

The relatively low share of distressed sales (2%) and the 27% share of all-cash transactions confirm that this is not a systemic credit crisis. Household balance sheets remain comparatively resilient, and underwriting standards are materially stronger than during prior housing downturns.

New construction also remains constrained. Elevated land costs, labor shortages, and material prices limit builders’ ability to expand supply rapidly. Building permits and housing starts show uneven progress, suggesting inventory normalization will take time.

The core dynamic, as we interpret in Your Daily Analysis, is not demand destruction but supply paralysis. The market is operating in a “low volume, high price” regime typical of late-cycle interest rate environments.

Several implications follow:

First, price stability is being sustained by scarcity rather than speculative demand.

Second, transaction weakness reflects capital costs, not collapsing household finances.

Third, meaningful recovery requires mortgage rates to fall sustainably below psychologically critical thresholds near 6%.

If monetary policy eases later in the year and Treasury yields retreat, housing activity could gradually recover. However, without parallel expansion in supply, price pressures will likely persist. For investors, selective exposure to well-capitalized homebuilders and firms with access to lower-cost financing may offer relative resilience. For policymakers, expanding supply – zoning reform, construction incentives, regulatory simplification – will be more effective than stimulating demand.

The U.S. housing market is neither overheating nor collapsing. It is constrained. As YourDailyAnalysis observes, until either borrowing costs fall decisively or supply meaningfully expands, muted volumes and price stickiness will define the landscape.